- Home

- Company

- Funds

- Investments

- Management & Team

- Career

- Contact

Impact investing in focus

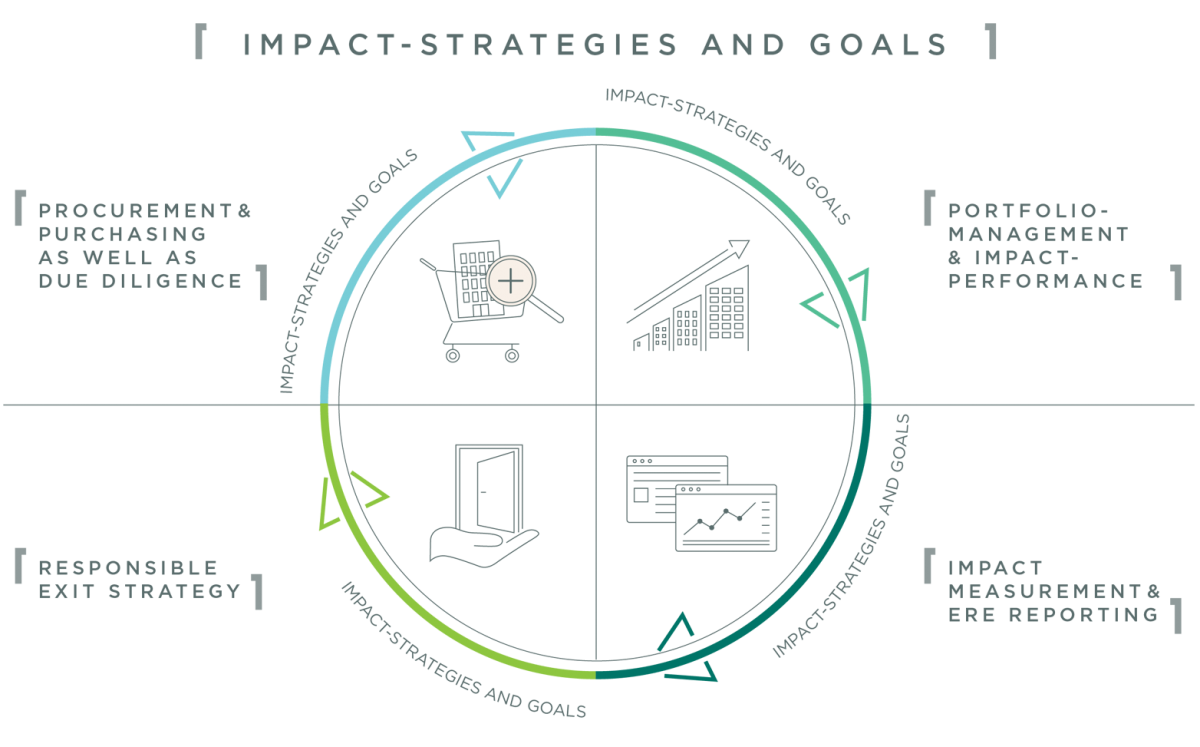

Impact investing is at the core of our investment strategy. From comparing potential investments to our investment priorities to the sourcing of objects based on defined impact criteria, to the definition and management of KPIs to maximize impact while minimizing risk, to the definition of an impact-oriented exit, we consistently incorporate the core concepts of impact investing into our investment process.

In addition to the intention of deliberately achieving a real net-positive impact through purchasing a property, the building must also generate measurable added value that can clearly be associated with the investment made. By consistently implementing an impact-oriented investment strategy in the defined priority areas, we can directly contribute to selected UN sustainability goals. In addition, we determine a possible indirect contribution to a number of other (additional) UN sustainability goals.

We contribute directly to the following UN sustainability goals:

Our evaluation process follows a multi-level assessment approach

When reviewing new investment opportunities, we pursue a multi-level assessment approach that includes the application of exclusion criteria as well as an internal and external review of the ESG and impact performance of each property (ESG and Impact Due Diligence). By applying a rigorous and consistent evaluation logic and methodology, we ensure that all properties in our portfolio are reviewed and assessed against general sustainability criteria (ESG perspective) as well as their impact orientation (impact perspective). Through the involvement of external experts, we guarantee objectivity in the assessment process and ensure additional resilience in our methodical approach.

An elementary component within the review of sustainability and impact performance is the consideration of sustainability risks. As part of the assessment process, both physical sustainability risks (e.g., environmental and climate risks) and so-called transition risks are identified and assessed accordingly. In particular, transition risks, which could have a significant impact on the value development of a property against the background of recent regulatory developments, are comprehensively addressed by determining the conformity of the respective property with the Paris Agreementt based on CO2 emissions and energy consumption.